You choose how you’ll make an impact.

Annual Fund

Your gift to Washburn Center’s Annual Fund is a direct contribution to the services that heal kids and families.

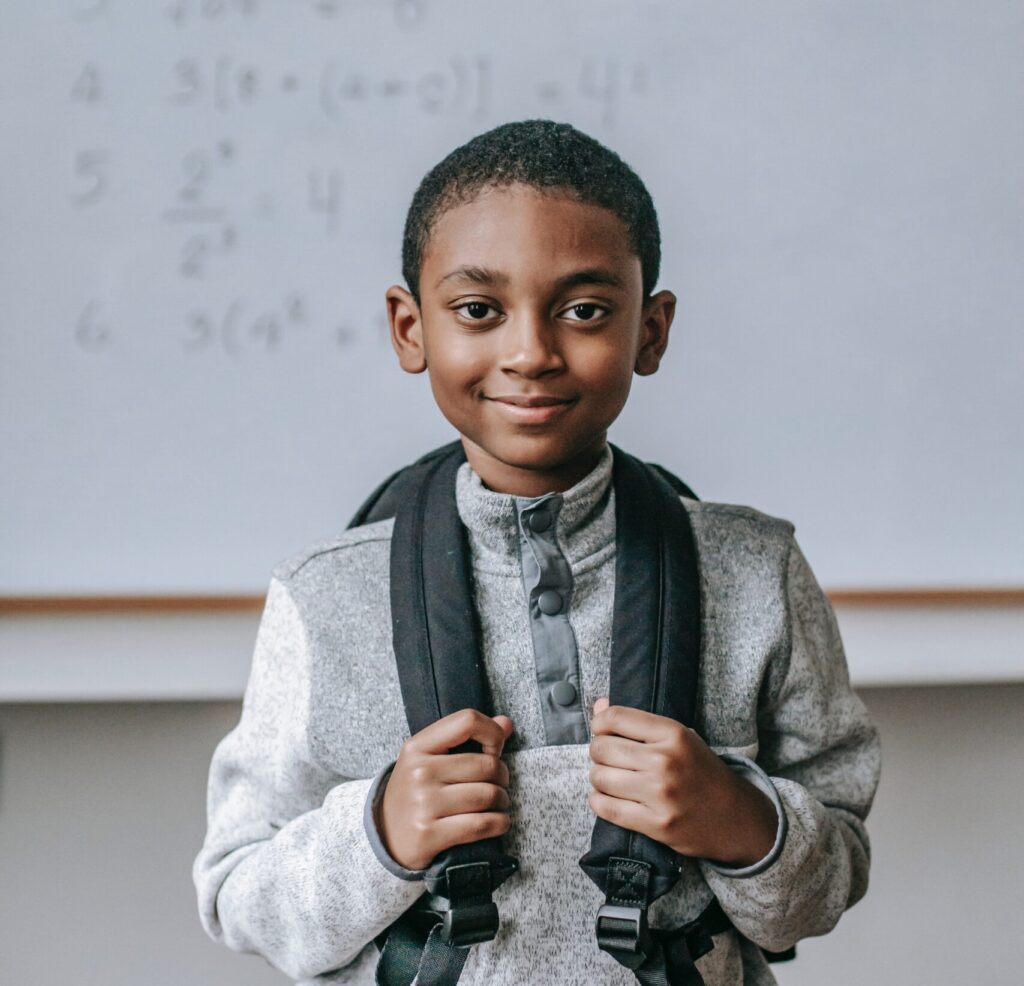

We serve children and families who live courageously and healing from generational poverty, systemic racism and trauma. They discover that the richest hope comes from getting the mental health care they need when they need it. They are our mission.

With your support, we do just that — even in the face of the long-standing, chronic underinvestment of mental health care, inflation, skyrocketing demand, and workforce pressures. Stagnant reimbursement rates only cover 60-70% of delivering services and remain insufficient to cover the cost of care. These are elemental factors putting pressure on our financial model as we answer an inconceivable surge in calls from families.

You make it possible for more families to hear “yes, services are available to help your child”. Donate today!

Planned giving

Your planned gift creates a legacy that lets your generosity flourish beyond your lifetime, helping Minnesota children and their families find deep and compassionate healing far into the future.

You’ll work with one of our team members to customize and match your needs. For more information, contact Development@washburn.org

Monthly giving

When you establish an automatic monthly gift, you commit to lasting impact for kids and families.

Simply, click “Donate” and select “monthly donation” and establish your giving level. You’ll quickly step through an easy giving experience. You set it up and we ensure your gift goes to work for clients calling for mental health care.

Your gift will be charged automatically to your credit card every month, on the date of your choice. You can adjust your giving level or change your commitment at any time. Donate today!

Stock gifts

You can choose to help make an impact on children’s mental health by leveraging your stock holdings. When you give stock (that’s been held for more than 12 months), you gain 3-fold — you build mission and get a tax deduction for the full fair market value of the stock on the date of the gift and mitigate capital gains.

If you’d like to understand more about stock giving, please email Development@washburn.org.

Tribute gifts

You can connect traditional gift-giving occasions to a meaningful mission. No matter the occasion, you can offer those who celebrate any special date with you a way to donate to Washburn Center for Children in lieu of gifts. You can select this as you plan your next birthday, anniversary, milestone, retirement or special event. Donate today!

Your gift will be the joy and hope that you are generating by helping Minnesota children step into healthier, happier futures. Please reach out to our team via Development@washburn.org with any questions.

Sponsorships

Make the most of community impact by exploring how to connect your business or organization with a mission that is helping children live into their full potential and strengthening futures.

Sponsoring or hosting an event is an opportunity for you and your employees to engage in making a difference. Click here to learn more. Please reach out to our team via Events@washburn.org.

Workplace Programs

Make the most of community impact by exploring how to connect your business or organization with a mission that is helping children live into their full potential and strengthening futures.

If you are an employee, check your company’s approach to matching giving to see if you can extend the support!

Our team can partner with you to create a workplace program or join an established one. Workplace programs let you and your employees magnify your impact and create hope as a team. Email our team: Development@washburn.org.